NELFUND Student Loan 2026: The Complete Guide to Eligibility, Application, and Repayment

Learn how to apply for the NELFUND Student Loan for 2026 using the official portal. See eligibility requirements, required documents, step by step application process, portal login guide, deadlines, upkeep allowance details, and repayment rules after NYSC. Updated guide for Nigerian university and polytechnic students.

The NELFUND Student Loan is one of the most important educational support schemes in Nigeria today. With tuition fees rising across public universities, polytechnics, and colleges of education, the Federal Government introduced this loan to ensure that no Nigerian student drops out because of financial constraints.

The 2026 edition of the loan program continues to offer interest free funding for institutional charges and optional upkeep allowance. This guide covers everything you need to know about the loan, including eligibility, required documents, portal registration, how to apply, deadlines, repayment rules, and common mistakes to avoid.

This is the most complete guide you can find and is fully updated using verified information from NELFUND announcements for the 2025 and 2026 academic sessions.

💡 Quick Summary:

The NELFUND Student Loan 2026 provides interest free funding for Nigerian students in public tertiary institutions. Applicants apply through the NELFUND portal using their JAMB or matric number. It covers school fees and optional upkeep, with repayment starting two years after NYSC.

What is the NELFUND Student Loan?

The NELFUND Student Loan is an interest free loan created by the Federal Government of Nigeria to help students in public tertiary institutions cover school fees and living expenses. The scheme is managed by the Nigerian Education Loan Fund.

The loan:

- carries zero interest

- is open to new and returning students

- is available to university, polytechnic, college of education, and vocational school students

- offers institutional charges and optional upkeep

- is repaid two years after NYSC

The goal is simple. No Nigerian student should be denied education because of financial hardship.

Portal Opening for 2025 and 2026 Academic Sessions

NELFUND announced that the student loan portal is open for the 2025 and 2026 academic seasons.

Application Window:

Thursday October 23 2025 to Saturday January 31 2026

Institutions are required to upload verified student data to the NELFUND Student Verification Portal before their students can apply. This includes both returning students and newly admitted candidates.

Fresh students can apply using their Admission Number or JAMB Registration Number.

Institutions that have not started their academic session must submit their academic calendar to NELFUND for scheduling flexibility.

Who Can Apply? Eligibility Requirements For 2026

You qualify for the NELFUND Student Loan if you meet the criteria below.

1. You must be a Nigerian citizen

Only Nigerian students in accredited public tertiary institutions are eligible.

2. You must be a student of a public institution

This includes:

- Federal and state universities

- Polytechnics

- Colleges of education

- Technical and vocational schools

Both part time and full time students can apply as long as they have a JAMB number.

3. Your institution must upload your data

If your school has not uploaded your details to the NELFUND dashboard, you cannot apply.

4. You must not have defaulted on any loan

Students who have unpaid loans from any licensed financial institution are not eligible.

5. You must not have been convicted of fraud related offenses

Disqualifying offenses include:

- document falsification

- exam malpractice

- forgery

- drug crimes

- cultism

6. There is no income restriction

The old household income limit has been removed. Any student who meets the other requirements can apply.

7. No age limit

Older students returning to school can also benefit.

Documents Required for Application

Before you start your online application, make sure you have the following ready.

- JAMB admission letter

- National Identity Number

- Bank Verification Number

- Matriculation number (new students can use JAMB number)

- Valid email address

- Valid bank account number

- Student ID card (optional)

- School fee invoice (optional)

Upload only clear scanned copies.

How to Apply for the NELFUND Student Loan 2026

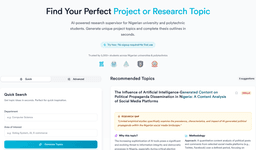

The loan application is done only through the official NELFUND portal.

Step 1: Visit the official portal

Go to nelf.gov.ng

Click Apply Now or Get Started.

Step 2: Create your account

Register with your email or log in if you already have an account.

Step 3: Verify your identity and student status

Confirm your:

- nationality

- JAMB or matric number

- institution details

The portal will authenticate your information with JAMB.

Step 4: Complete your profile

Provide your:

- personal details

- contact information

- educational data

- banking information including BVN

Step 5: Request for the loan

On your dashboard, click Request for Student Loan.

Choose:

- Institutional charges only

or - Institutional charges plus upkeep

Step 6: Upload your documents

Upload your JAMB admission letter.

You may also upload your student ID and fee invoice.

Agree to the declaration and policies.

Step 7: Review and submit

Cross check all your details carefully.

Agree to the Terms and the Global Standing Instruction mandate.

Submit your application.

Step 8: Check your loan status

Go to the Loans section of your dashboard.

Notifications will also be sent to your email.

How Much Can You Get From the NELFUND Loan?

The actual loan amount varies by institution since institutional charges differ. The loan covers:

- tuition and mandatory fees

- optional upkeep allowance to support feeding, transport, and accommodation

The upkeep amount is calculated based on your institution and program.

Repayment Terms for the NELFUND Student Loan

NELFUND uses one of the simplest and most flexible repayment systems in Nigeria.

1. Zero interest

The loan is completely interest free.

2. Repayment begins two years after NYSC

Your repayment countdown starts two years after your NYSC service ends.

3. Repayment rate

Beneficiaries must pay:

- 10 percent of their salary if employed

- 10 percent of monthly profit if self employed

Employers deduct and remit automatically.

4. What happens if you are unemployed after NYSC?

If you are not employed two years after NYSC, you must notify NELFUND through a sworn court affidavit every three months until you secure a job.

5. Loan forgiveness

NELFUND may write off the loan if:

- the beneficiary dies, or

- the beneficiary suffers a permanent disability that makes earning impossible

Common Mistakes You Must Avoid

To avoid delay or rejection, do not make these mistakes:

- applying before your institution uploads your data

- using mismatched NIN, BVN, or name spelling

- uploading blurred documents

- providing the wrong bank account

- failing JAMB authentication

- ignoring portal notifications

Important NELFUND Contact Channels

For inquiries or technical issues, use the official NELFUND support lines:

- Email: data@nelf.gov.ng

- X (Twitter): @nelfund

- Instagram: @nelfund

- Facebook: Nigerian Education Loan Fund

- LinkedIn: Nigerian Education Loan Fund

- Website: nelf.gov.ng

Here are the SEO optimized slug, meta description, title, and full FAQ section for your article on NELFUND Student Loan 2026.

Everything is optimized to rank for the top keywords you listed including:

tinubu student loan portal, nelfund login portal, nelfund application portal, fg student loan portal login, how to apply for tinubu student loan in nigeria, nelfund portal registration, student loan eligibility, student loan repayment rules, nelfund application steps, student loan 2026.

FAQs

What is the NELFUND Student Loan?

The NELFUND Student Loan is a Federal Government scheme that gives interest free loans to Nigerian students in public universities, polytechnics, colleges of education, and vocational schools. It covers school fees and optional upkeep and repayment starts two years after NYSC.

Who is eligible for the NELFUND Student Loan 2026?

Any Nigerian student in a public tertiary institution can apply if their school has uploaded their records to the NELFUND dashboard. The applicant must not have defaulted on any bank loan and must not have been convicted of fraud, forgery, exam malpractice, drug offences, or cultism.

How do I apply for the NELFUND Student Loan in Nigeria?

Visit nelf.gov.ng, create an account, verify your JAMB or matric number, complete your profile, upload your admission letter, and click Request for Student Loan on your dashboard. Choose whether you want institutional charges only or charges plus upkeep and then submit your application.

What documents do I need for the NELFUND Student Loan?

You need your JAMB admission letter, NIN, BVN, email address, bank account, matric number or JAMB number, and optional student ID and institution invoice. Upload clear scanned copies during your application.

What is the NELFUND login portal for the student loan?

The official login portal is portal.nelf.gov.ng. Students can register, sign in, request a loan, upload documents, and check loan approval status from the portal.

Is the NELFUND Student Loan interest free?

Yes. The loan carries no interest. Beneficiaries only repay the exact amount borrowed.

When does repayment for the NELFUND loan start?

Repayment starts two years after the completion of NYSC. Those employed will have 10 percent of their salary deducted by their employer while self employed beneficiaries must remit 10 percent of their monthly profit.

Can unemployed students delay repayment?

Yes. If a beneficiary is still unemployed two years after NYSC, they must submit a sworn court affidavit every three months to notify NELFUND until they secure a job.

Will the loan be forgiven in any situation?

Yes. The loan may be written off if the beneficiary dies or suffers a permanent disability that prevents them from earning a living.

When is the NELFUND application deadline for 2025 and 2026?

The portal is open from October 23 2025 to January 31 2026. Students must apply before the closing date and ensure their institution has uploaded their verification data.

Can new students apply without a matric number?

Yes. Fresh students can apply using their JAMB registration number in place of a matric number.